Economy

-

Gabon/indice de performance logistique:

La banque mondiale (BM) vient de rendre public l'indice de performance logistique, pour l'année 2025, lequel mesure les performances des pays en matière de douanes, d'infrastructures, d'expéditions et de logistique. Un rapport qui classe le Gabon à la 115ème place sur 139 pays. Un rang qui fait grincer les dents.

Article's detail -

Gabon/Succession à BGFIBANK :

Après 40ans à la tête de BGFIBank Henri-Claude Oyima sait déjà qui pourrait lui succéder. Car, dans une interview exlusive accordée à EcoMatin, un site d'information camerounais, et paru récemment, Henri-Claude Oyima révèle avoir déjà en tête le nom et le profil de son successeur à la tête de BGFIBank, tout en excluant toute précipitation.

Article's detail -

Henri-Claude Oyima dévoile ses reformes chocs

Entre grand discours et réalités, le Ministre d’Etat, Henri-Claude Oyima a tracé sa feuille de route pour une nouvelle ère dans la gestion des finances publiques basée sur des réformes structurelles.

Article's detail -

L’apport de la BCEG dans le financement de l’économie

la BCEG se positionne comme un moteur dans la croissance et le développement des activités économiques au Gabon du rôle de l’épargne à l’investissement.

Article's detail -

SEEG : Vers une séparation des activités Eau et Energie

Selon le Ministre de l’Accès Universel à l’Eau et à l’Energie, Phillipe TANANGOYE, le processus de séparation de la SEEG en deux entités distinctes (Eaux et Energie) est une phase d’étude, incluant la certification des comptes, l’évaluation patrimoniale, la détermination de l’actionnariat et la création juridique des nouvelles sociétés. Plus précisément, cette opération de scission-création-absorption prévoit la fusion de la société de Patrimoine et de Gabon Power Company -GPC) et l’intégration du CNEE et de la SETEG aux nouvelles structures ainsi que le renforcement de l’Autorité de Régulation du Secteur de l’Eau et de l’Energie.

Article's detail -

l’Etat gabonais renforce les capacités de mobilisation du secteur des assurances

Selon le Ministre de l’Economie et des Finances, Henri-Claude OYIMA, le projet de décret portant obligation de saturation des capacités d’assurance et réassurance du marché local avant toute cession de réassurance facultative à l’étranger permettra d’accroitre la rétention des primes sur le territoire, de réduire les transfert de capitaux vers l’extérieur et, partant, de consolider le financement domestique du secteur des assurances, en cohérence avec les objectifs de souverainetés économique du Gouvernement.

Article's detail -

Analyse approfondie de la crise du Fonds Gabonais d’Investissement Souverain (FGIS)

Le Fonds Gabonais d’Investissement Souverain (FGIS), doté d’un capital proche de 200 milliards de FCFA à sa création, représente aujourd’hui un cas paradigmatique de gestion financière défaillante au sein des fonds souverains africains. Miné par des dysfonctionnements conjoncturels et structurels, le FGIS n’est plus que l’ombre de lui-même.

Article's detail -

La COBAC projette de relever le capital minimum des banques

La Commission bancaire de l’Afrique centrale (COBAC) vient d’annoncer une réforme majeure visant à renforcer la solidité du système bancaire au sein de la Communauté économique et monétaire de l’Afrique centrale (CEMAC). À compter du 1er janvier 2026, et de manière progressive jusqu’en 2029, le capital social minimum exigé des banques passera de 10 à 25 milliards FCFA. Parallèlement, le seuil applicable aux établissements financiers non bancaires sera porté de 1 à 4 milliards FCFA. Cette hausse significative s’inscrit dans le cadre du plan stratégique « OWALI 2025-2029 ».

Article's detail -

Gabon Moves Forward on “Blue Bonds”

On Thursday, November 13, 2025, Gabon reached a significant milestone in the implementation of its “Blue Bonds” project. The Minister of the Sea, Fisheries, and Blue Economy, Laurence Ndong, chaired the first ordinary session of the Project Steering Committee (COPIL).

Article's detail -

PLF 2026: The Senate Scrutinizes the Budget Presented by Henri-Claude Oyima

The 2026 Finance Bill, totaling 6,358.2 billion FCFA with a funding requirement of 2,204.3 billion FCFA, was presented by Henri-Claude Oyima before the Senate. Senators reviewed the main budgetary outlines, the management of public finances, and social commitments, emphasizing discipline, transparency, and execution efficiency.

Article's detail -

Gaboprix, the weak link: CECA-GADIS is faltering.

The General Director of CECA-GADIS, Isabelle Essonghe, points directly to the Gaboprix department as responsible for the group's current difficulties. Between falling turnover, repeated losses, and the closure of 43 stores, the survival of the company and over 2,000 jobs are now threatened.

Article's detail -

Gabon's Bet to Reform its Public Finances

In a press release from the Ministry of Economy, Finance, Debt, and Participations, in charge of the fight against the High Cost of Living, published on November 14, 2025, the Gabonese Government unveiled a series of reforms designed to modernize the management of public finances, refocus debt on productive investment, and stimulate growth starting in 2026. Driven by an optimistic projection of 6.5%, this strategy is intended to be the matrix for new budgetary governance. However, its operational feasibility remains in question, as public management is still marked by structural fragilities. The success of the plan will depend on the ability to establish lasting managerial discipline.

Article's detail -

Strike Notice at the CDC: Between Union Blackmail and Stalled Dialogue.

Our editorial team conducted an investigation into the strike notice filed by the workers' union of the Caisse des Dépôts et Consignation (CDC), which is visibly accompanied by a targeted communication campaign against its General Administrator-Director (GAD). We present our analysis of this burning issue, which smells of a settling of scores.

Article's detail -

The Financial Analyst, Willy Ontsia, Denounces Bloomberg's Erroneous Projections

A recent report by the Bloomberg agency has sent a shockwave by describing Gabon as a state "on the verge of bankruptcy." What is your opinion on this claim by Bloomberg ?

Article's detail -

The AfDB wants to reshape the architecture of African stock exchanges

On November 18 and 19, under the impetus of the President of the African Development Bank (AfDB), Mr. Sidi Ould Tah, more than fifty senior officials from regional banks, major African stock exchanges, and private equity and venture capital funds met during the first structured meeting between the AfDB and the continent's stock markets.

Article's detail -

The 2026 Finance Act Opens a New Economic and Financial Era for Gabon

The draft 2026 Finance Bill, announced under the presidential impulse of Brice Clotaire Oligui Nguéma and steered by his Minister of the Economy and Finance, Henri-Claude Oyima, establishes an ambitious budget exceeding 6000 billion FCFA. This budget constitutes the cornerstone of a new economic development model structured around six strategic pillars. This overhaul aims for a significant acceleration of growth and a sustainable diversification of the Gabonese economy.

Article's detail -

The Paradox of the Gabonese Economy: The Multi-Year Rise in National Wealth Contrasts with the Continuous Decline in the Standard of Living of the Gabonese Population.

This report by the World Bank Group teaches us that, in terms of national wealth, Gabon saw its overall capital—including natural, human, and physical capital—grow by 35% between 1995 and 2020, reaching 105 billion dollars in real chain-linked 2019 dollars (or approximately 65.508 billion CFA francs). This wealth is dominated by natural capital, which accounts for 42% of the total, followed by human capital (31%) and physical capital (27%).

Article's detail -

Gabon's Economic Trajectory: The World Bank Forecasts 2.4% Growth Versus 6.5% According to the Gabonese Government's Draft 2026 Finance Law.

According to the latest economic report on Gabon published by the World Bank Group, Gabonese economic growth, which reached 2.9% in 2024, is expected to slightly decrease between 2025 and 2027, with anticipated growth of around 2.4% per year. This slower progression is primarily attributed to lower performance in the oil sector, high public debt, cash flow tensions, and a fiscal situation that deteriorated in 2024. Specifically, the decline in oil revenues, combined with an increase in public spending, widened the budget deficit, thereby increasing the risks related to public finance sustainability. This trend underscores the urgent need for rigorous management and diversification of revenue sources to stabilize the State budget in the medium term.

Article's detail -

Government Seminar on the 2026 Finance Act

This Wednesday, December 3, 2025, at 10:00 AM, the auditorium of the Ministry of Economy in Arambo, Libreville, will host a crucial government seminar. Under the direction of Minister of State Henri-Claude OYIMA, Vice-President of the Government for the interim period and in charge of Economy, Finance, Debt, Participations, and the fight against the high cost of living, this seminar will also bring together Louise Pierrette MVONO, Minister of Planning, Foresight, Oil, and Gas for the interim period.

Article's detail -

Gabon's Central Purchasing Agency: A Possible Remedy in the Fight Against the High Cost of Living?

Since the adoption of the CEAG in mid-2025, Gabon hopes to contain the inflation of foodstuffs and essential goods, which is weighing heavily on household purchasing power. The appointment of the Director General during the Council of Ministers meeting on December 4th marks the concrete launch of a structure intended to pool purchases, stabilize prices, and guarantee regular supply. For vulnerable families, the impact could be real — if the State manages to implement its commitments with transparency and efficiency.

Article's detail -

SIGFiP: The Digital Revolution at the Heart of Gabonese Financial Management.

Knowing that the official launch is scheduled for January 2026, the Integrated Public Finance Management System (SIGFiP) embodies a major step forward for Gabonese economic governance. This digital platform centralizes and modernizes the management of public revenue and expenditure, bringing together the Treasury, Taxes, Customs, and other key entities under a single system, thus ensuring unprecedented coherence.

Article's detail -

Why Do Multinational Corporations Violate Foreign Exchange Regulations with Impunity?

Dependence on raw materials and the incomplete application of regulations make the zone vulnerable to external shocks and impact the BEAC's monetary policy.

Article's detail -

Governmental Seminar: Progress Review on the Implementation of the 5 Strategic Funds Announced by the Government.

Meeting for a seminar in Libreville, members of the government reviewed the progress of the five strategic funds established to support Gabon's economic and social transformation. While concrete advances have been registered in several key sectors, financial, technical, and regulatory obstacles still hinder the full implementation of these instruments intended to accelerate national development.

Article's detail -

Gabon Ranks 8th Worldwide on the List of Countries Most Exposed to Money Laundering and Financial Crime

According to the latest Basel Anti-Money-Laundering Index 2025, published by the Basel Institute on Governance, Gabon is ranked 8th globally and 4th in Africa on the list of countries most exposed to money laundering and financial crime. This rating, which measures the vulnerability of 177 nations based on 17 rigorously established criteria by influential bodies such as the Financial Action Task Force (FATF), Transparency International, and the World Bank, highlights major flaws in the Gabonese system.

Article's detail -

President Oligui Nguema Drives a Reshaping of Economic Partnerships in Gabon

Libreville, December 17, 2025 – In a display of dynamism and resolve, the President of the Republic, Head of State, and Head of Government, His Excellency Brice Clotaire Oligui Nguema, granted an audience on Tuesday to two major delegations: the Ciment d’Afrique (CIMAF) group, led by its CEO Mr. Anas Sefrioui, and the Chinese group HUNAN XINZHONAO INVESTMENT, currently on a prospecting mission in Gabon.

Article's detail -

The CEMAC zone anticipates a growth rate of 3.4% in 2026, with agriculture and infrastructure as drivers of sub-regional development.

The Commission of the Economic and Monetary Community of Central Africa (CEMAC) has announced a forecast of regional economic growth at 3.4% in 2026, up from the 2.7% expected for 2025. This trajectory, welcome in a global context marked by geopolitical uncertainty and climate shocks, rests on two solid pillars: revitalized agriculture and a boom in public works. Beyond the figures, this dynamic reflects the early successes of diversification strategies, long called for to break dependence on hydrocarbons.

Article's detail -

Gabon is massively attracting foreign investors: 640 billion CFA francs in FDI in 2024.

Gabon confirms its growing appeal to international investors, with a record flow of Foreign Direct Investment (FDI) amounting to USD 1.145 billion (around CFA 640 billion) in 2024. This exceptional performance, announced by official sources, includes ‘Greenfield’ projects valued at USD 976 million, reflecting strong enthusiasm for the opportunities offered by the country.

Article's detail -

Fitch Ratings has downgraded Gabon’s sovereign credit rating to CCC-, citing the country as facing ‘substantial credit risk’ with a ‘very concerning’ solvency outlook.

Libreville, December 20, 2025 – Fitch Ratings has once again struck hard by downgrading Gabon’s sovereign credit rating to CCC-, placing the country among those facing “substantial credit risk” with a “very concerning” solvency outlook. According to Fitch, public debt is projected to climb to 86.6% of GDP over the 2023–2027 period, far exceeding the 70% threshold set by CEMAC, while the budget deficit is expected to widen from 1.3% to 2.3% of GDP and growth remain limited at 2.7%. Stable inflation at 1.7%, net external debt at 25% of GDP, and foreign direct investment capped at 4.1% complete this bleak picture, threatening “deteriorating fiscal flexibility,” payment arrears, and a heightened risk of default—potentially to be addressed through recourse to the IMF.

Article's detail -

Gabon Shines on the Sub-Regional Financial Market: Resounding Success of the EOG 6.25% Bond Against International Cassandras

Libreville, December 22, 2025 – Amid global budgetary tensions, the State of Gabon has just achieved a remarkable breakthrough on the financial market. The public bond issue “EOG 6.25% Net 2023–2028” successfully raised USD 190 million, equivalent to CFAF 118 billion, oversubscribed by more than 212%. This resounding success stands in stark contrast to the bond issues of 2024, which were often hampered by weak investor participation and repeated extensions.

Article's detail -

Mont-Bouet : Régulation du plus grand marché de Libreville pour lutter contre l’informel et les transferts d’argents hors impôts et taxes

Le quartier Mont-Bouet, célèbre pour abriter le plus grand marché de Libreville, s’apprête à faire l’objet d’une régulation stricte visant à améliorer l’inclusion et la sécurité financière ainsi que la transparence des transactions financières des commerçants avec leurs clients et vis-à-vis des impôts et taxes à payer l’Etat gabonais. Ce projet répond à une problématique majeure : les transferts d’argent réalisés dans l’informel, hors du circuit bancaire classique, qui échappent au contrôle fiscal, privant ainsi l’État de recettes essentielles.

Article's detail -

Towards Strengthening Cooperation Between Gabon and the World Bank

The Minister of Economy, Finance, and Debt, in charge of the Fight Against the High Cost of Living, Henri-Claude Oyima, recently co-chaired a working session at the World Bank's regional headquarters in Yaoundé, Cameroon, alongside regional representatives of the institution. The objective of this meeting was to study mechanisms for better World Bank support in implementing Gabon's priority projects included in the National Development and Growth Plan (PNDC).

Article's detail -

Increase in CNSS Employer and Employee Contributions Starting January 1, 2026: Benefits Remain Unchanged

"This policy requires deep reflection to prevent the social burden from becoming a major obstacle to employment and the financial stability of Gabonese households."

Article's detail -

Gabon-China: Towards a Total Customs Duty Exemption—A Strategic Opportunity for the Gabonese Economy

"Without these adjustments [strengthening productive and logistical capacities], the removal of duties will not necessarily translate into significant economic gains."

Article's detail -

Le PNCD : Boussole stratégique du deuxième gouvernement de la Vème République.

Un nouveau plan, le PNCD 2026-2030, est lancé avec une ambition de 10 000 milliards FCFA pour transformer l'économie vers une croissance de 10% et une économie de transformation. Les défis incluent la mobilisation des fonds nécessaires (estimés à 775 milliards FCFA annuels) et le pivot de l'économie extractive vers l'industrie. Le Gouvernement compte sur la mobilisation de partenaires financiers (BAD, AFD), investissements privés et réformes pour attirer les capitaux.

Article's detail -

Pénurie de gaz : le plan d'urgence logistique soumis au ministre Kondja

Le but est de résorber cette crise "dans les quinze jours qui viennent", grâce à l'instauration d'un fonctionnement des centres de remplissage 24 heures sur 24.

Article's detail -

Strategic Meeting Held by Minister Thierry Minko

Libreville, January 12, 2026 – Just eleven days after his appointment on January 1st, the Minister of Economy and Finance, Thierry Minko, convened a meeting this Monday with the heads of central administration and supervised government entities.

Article's detail -

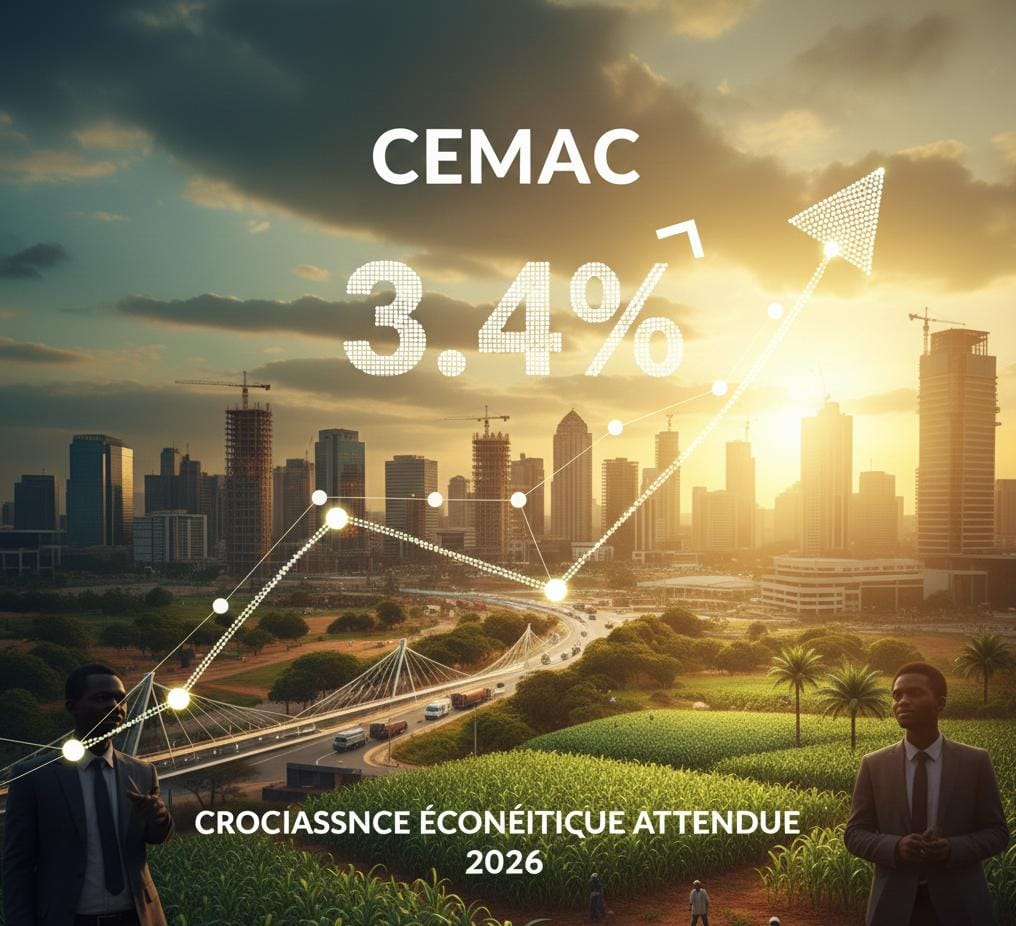

The 2026 Finance Act introduces the Standardized Electronic Invoice.

Starting from the 2026 fiscal year, your business could become illegal… without you even knowing it. A simple sale, a service rendered, a forgotten receipt… and suddenly, you risk a fine equivalent to your entire transaction, or even more. Here is everything you need to know.

Article's detail -

Henri-Claude Oyima Launches the New 2026-2030 Strategic Cycle to Strengthen the African Leadership of Central Africa’s Leading Financial Group

"By encouraging collective reflection and open dialogue, the holding company ensures that every employee becomes a stakeholder in this transformation."

Article's detail -

Gabon: President Brice Clotaire Oligui Nguema Accelerates the Belinga Project with Mining Giant Fortescue

"A true lever for industrial and economic transformation, this project notably includes the construction of a mineral railway, a deep-water port, and the development of structural energy infrastructure."

Article's detail -

Expansion of Mercure International: Brice Clotaire Oligui Nguema Bets on Trade to Boost Employment

"By facilitating investments from Mercure International, the State encourages a virtuous circle where private development supports social stability."

Article's detail -

CDC : Le nouveau rempart de la souveraineté financière gabonaise.

Ce 15 janvier 2026, le Président Brice Clotaire Oligui Nguema a inauguré le siège flambant neuf de la Caisse des Dépôts et Consignations. Fruit du génie national, cet édifice symbolise une administration gabonaise moderne, déterminée à sécuriser les ressources publiques tout en propulsant des chantiers structurants pour l'émergence économique.

Article's detail -

Gabon : Cap sur l'arrêt de l'importation du poulet de chair d'ici 2027

Dans le cadre de ses visites de terrain, le Chef de l’État s’est rendu dans le département du Komo pour soutenir la production locale. Cette initiative vise à transformer le secteur agricole gabonais afin de réduire la dépendance aux importations, avec pour objectif majeur l'autosuffisance en poulets de chair d'ici trois ans.

Article's detail -

PNDC 2026-2030 : Le Gouvernement lance un appel à contribution citoyenne

Pour affiner son Plan National de Développement et de Croissance, le Ministre de la planification a ouvert une consultation populaire pour permettre aux gabonais de participer à la co-construction de ce programme quinquennal.

Article's detail -

Gabon Suffers Setback at ECCAS: Postponement of General Yves-Marcel Mapangou’s Candidacy for Commissioner for Political Affairs

"On January 16, the Council of Ministers met in preparation for the 9th Extraordinary Session of the ECCAS Heads of State, dedicated to the appointment of new commissioners and other officials for this sub-regional institution. These provisional selections must be ratified by the Conference of Heads of State. For the second time, Gabon faces the risk of being excluded from the ECCAS Directorate, despite its headquarters being located in Libreville, Gabon. Competing against the candidate from the Central African Republic (CAR)—who is favored by the recruitment firm and a portion of the ECCAS members—the Gabonese candidacy will be submitted once again during the extraordinary session of the Heads of State, scheduled to take place this week via videoconference.

Article's detail -

Interdiction d'importation du poulet: La 2ème réunion du Comité Technique avance sur le programme de mise en œuvre de cette reforme.

Le Conseiller spécial du Président en charge de l’Agriculture, ainsi que les Secrétaires généraux et Directeurs généraux des ministères concernés, ont activement participé aux échanges. De nouvelles réunions et comités techniques sont prévus pour peaufiner la mise en œuvre.

Article's detail -

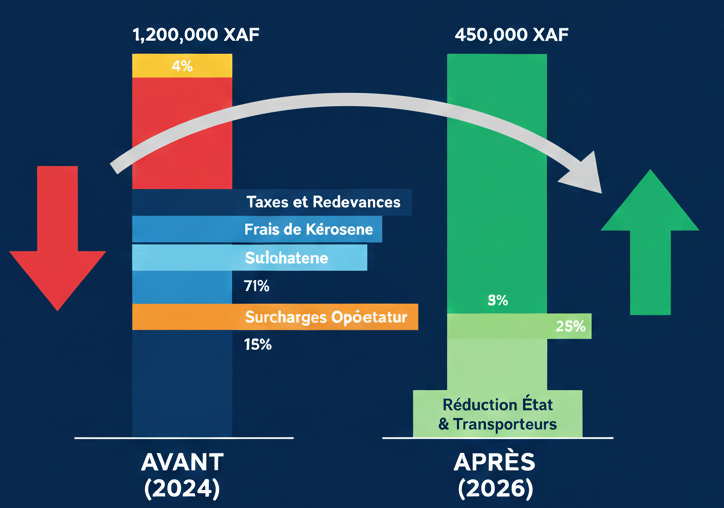

Aérien : Libreville exige une refonte structurelle du service et des tarifs de la compagnie Air France

« Le ministre d’État a exprimé sa vive inquiétude face à l’accumulation des taxes et redevances qui pèsent lourdement sur le coût final supporté par les passagers. »

Article's detail -

Secteur Pétrolier : ENIVA Petroleum se positionne pour devenir un champion national

Le Gabon franchit une étape décisive dans sa stratégie énergétique avec la signature d’un Contrat d’Exploitation et de Partage de Production entre l’État et ENIVA Petroleum SA. Cet accord, porté par des investisseurs locaux, vise une hausse immédiate de la production nationale de 1 300 barils par jour, marquant ainsi une volonté ferme de valoriser l'expertise gabonaise au sein d’un secteur traditionnellement dominé par les multinationales étrangères.

Article's detail -

Central Africa: Faced with the risk of devaluation, the IMF convenes a conference of CEMAC Heads of State.

The extraordinary session of the CEMAC Heads of State Conference, to be held on January 22, 2026 in Brazzaville, comes at a critical juncture characterized by a projected slowdown in growth to 2.4% in 2025 from 2.7% in 2024, mounting fiscal pressures, a decline in the monetary coverage ratio from 74.9% to 67% in 2025 reflecting the erosion of foreign reserves, and excessive sovereign indebtedness across the zone, despite inflation stabilizing at 2.7%. Following a preparatory videoconference of the UMAC Ministerial Committee, the Brazzaville summit will focus on assessing the economic, financial and monetary situation and on defining urgent measures to address regional challenges. This article examines the key strategic stakes of the summit in light of recent developments in the sub-region.

Article's detail -

Infrastructure portuaire : Le Gabon signe une convention historique pour la gare maritime de Libreville.

Le Gabon franchit une étape décisive avec la signature d'une convention de concession entre l'OPRAG et AOM Group. Ce projet ambitieux prévoit la construction d'une gare maritime moderne à Libreville, favorisant la création d'emplois et l'excellence des standards logistiques internationaux.

Article's detail -

Transformation économique : Le Gabon s’affirme comme le nouveau pilier de stabilité en zone CEMAC

Après d’intenses négociations techniques, le Gabon a validé un nouveau programme avec le FMI. Cette initiative cruciale cible le renforcement de la transparence financière et l’amélioration concrète du bien-être social. Elle s'inscrit parfaitement dans la stratégie budgétaire de l'année 2026.

Article's detail -

Aviation Sector: Is the End of Sky-High Prices Finally Near?

Gabon is relaunching its fight against expensive air travel by establishing yet another strategic technical committee. Following unsuccessful attempts in 2019 and 2024, this body must move beyond simple fiscal debate to explore concrete solutions. The stakes are high: transforming political intentions into real reductions for users while stabilizing economic relations between public administration and private sector operators.

Article's detail -

Ban on Raw Manganese Exports: The State and Eramet Group Adopt Strategic Program

This Monday, January 26, 2026, a strategic videoconference meeting marked a decisive turning point for the Gabonese economy under the leadership of the Minister of Mines. In collaboration with the Ministries of Industry and Planning, as well as the Eramet-Comilog group, authorities reaffirmed their commitment to processing natural resources on national soil. This high-level consultation aims to finalize the major agreements reached during the last presidential visit.

Article's detail -

Secteur alimentaire : instauration d'une Brigade de contrôle mixte

Le Gabon adopte un cadre strict pour ses investissements publics. L’objectif est d’aligner chaque dépense sur les priorités nationales, comme la sécurité alimentaire, et d’instaurer une rigueur budgétaire et une évaluation systématique des résultats.

Article's detail -

Gabon highlights its economic potential during the 5th mission of the Africa Development Club.

On January 29, Gabon hosted the 5th multisectoral mission of the Africa Development Club, organized by the Attijariwafa Bank Group and its subsidiary, Union Gabonaise de Banque, in partnership with the National Agency for the Promotion of Investments of Gabon (ANPI-Gabon). Held under the theme ‘Gabon, Land of Opportunities,’ this meeting is part of a dynamic effort to promote investment and strengthen economic exchanges between Gabon and its regional and international partners.

Article's detail -

Eramet Dismisses its Chief Executive Officer: What Impact for Gabon?

Appointed less than a year ago, Paulo Castellari is thus leaving his position ahead of schedule. The Board of Directors has not detailed the nature of the disagreements, though it specified that they concerned issues of approach and governance.

Article's detail -

Gabon Goes Electric: 50 Ndzela Taxis Enter Service

Gabon is taking a major step forward in the modernization of its urban transport with the official handover of 50 Ndzela electric taxis to Gabonese beneficiaries. This operation marks the effective launch of a pilot project aimed at promoting cleaner, more modern, and environmentally friendly mobility.

Article's detail -

Suspension provisoire des activités de la Commission de la CEMAC.

Le 8 février 2026 marque un tournant critique pour l’Afrique Centrale. Faute de financements issus de la Taxe d’Intégration Communautaire (TIC), la Commission de la CEMAC a annoncé l’arrêt de ses missions administratives. Si le système monétaire survit, l'ensemble de la zone voit ses projets de diversification et ses chantiers transfrontaliers menacés par cette paralysie

Article's detail -

Anarque achat en ligne auto-chinoise : méfiez-vous des offres trop belles pour être vraies

Sur Facebook, Instagram et TikTok, les pubs fleurissent : "Voiture chinoise neuve à 3 millions FCFA ! Livraison gratuite au Gabon !" Des images rutilantes de SUV MG ou Chery font rêver. Mais derrière ces offres alléchantes se cache une escroquerie bien rodée qui plombe les finances de centaines de Gabonais et d'Africains chaque mois.

Article's detail -

Corruption : le Gabon classé 135e sur 182, un signal d’alerte pour l’attractivité et la gouvernance

Libreville - Avec un score dégradé et une 135e place sur 182 pays, le Gabon reste durablement ancré dans le bas du classement de Transparency International. Loin d’être anecdotique, ce rang expose le pays à des répercussions systémiques qui dépassent la seule réputation internationale.

Article's detail -

Secteur Agricole : Le Ministre reçoit les investisseurs des Émirats Arabes Unis

Cette audience a permis d'identifier plusieurs filières porteuses pour une collaboration future. Les échanges ont mis en lumière l'ambition partagée de développer des projets intégrés, notamment dans la production de poulet de chair sur l'ensemble de sa chaîne de valeur, de la couvaison à la transformation. Le secteur laitier a également été abordé, avec la perspective d'unités de production locales visant à réduire la dépendance aux importations. Par ailleurs, la relance de la riziculture nationale a figuré au cœur des discussions, filière prioritaire pour garantir l'autosuffisance du pays.

Article's detail -

Coris Bank s'implante au Gabon

Derrière la poignée de main et les salutations d'usage, c'est bien une vision commune du développement qui s'est esquissée dans le cabinet présidentiel. Le Chef de l'État a salué avec insistance l'intérêt manifesté par Coris Banque pour le marché gabonais, voyant dans cette décision une adhésion aux réformes engagées. Plus qu'une simple implantation, le groupe a promis de s'attaquer au financement des projets structurants prioritaires à travers le territoire. Un engagement qui tombe à point nommé alors que le Gabon cherche à accélérer sa diversification économique.

Article's detail -

Secteur Pétrolier : Vaalco Gabon renforce sa production.

La compagnie américaine Vaalco Energy annonce des résultats encourageants après la mise en production du puits Etame 15H-ST sur le champ offshore d’Etame, au large du Gabon. Avec un débit stabilisé proche de 2 000 barils par jour, l’entreprise renforce ses perspectives de croissance et poursuit son programme d’exploration dans la zone West Etame.

Article's detail -

Secteur aurifère : Mise en place d'un système de traçabilité de production nationale d'or

Le sous-sol gabonais regorge de richesses, mais son or reste, pour l'heure, un trésor qui profite davantage aux circuits clandestins qu'au Trésor public. Avec une production artisanale estimée à plusieurs tonnes, seule une infime fraction est officiellement déclarée. Ce manque à gagner colossal prive le pays de ressources essentielles pour le financement de son développement en cette période de transition.

Article's detail -

Le Gabon évalue son industrie pour bâtir une économie plus diversifiée

Le Gabon, soutenu par la Banque africaine de développement, a présenté les résultats d’une enquête nationale visant à actualiser les données du secteur industriel. L’objectif est d’identifier les principaux défis, améliorer la structuration des entreprises et renforcer la diversification durable de l’économie.

Article's detail -

Le FMI en mission à Libreville pour évaluer la solidité des finances publiques

Une mission technique du Fonds monétaire international a débuté ce mercredi 25 février à Libreville afin d’évaluer le cadre budgétaire du Gabon. Objectif : examiner la crédibilité des finances publiques et apprécier les conditions d’un possible programme d’appui, dans un contexte économique sous tension.

Article's detail -

Le Gabon mise sur six fonds sectoriels pour transformer le financement de son économie.

Le 24 février 2026, une réunion stratégique de haut niveau s’est tenue au Fonds Gabonais d'Investissements Stratégiques (FGIS) pour accélérer la mise en place de six fonds sectoriels prioritaires. Inscrite dans la feuille de route des 100 jours du Gouvernement, cette initiative vise à structurer durablement le financement des secteurs clés et à renforcer la capacité de mobilisation des ressources internationales.

Article's detail -

La BEAC et le FMI unissent leurs efforts à Yaoundé pour anticiper la révolution des monnaies numériques en CEMAC

Enjeux pour les pays CEMAC : Cette initiative renforce la coordination interinstitutionnelle, essentielle pour les six États (Cameroun, Centrafrique, Tchad, Congo, Gabon, Guinée équatoriale) confrontés à une adoption croissante des crypto-actifs malgré un cadre juridique embryonnaire. Elle pave la voie à une MNBC qui pourrait booster l'inclusion financière – avec plus de 50% de la population non bancarisée – tout en préservant le monopole du FCFA.

Article's detail -

BGFI Holding Corporation triomphe à la BVMAC : 45,3 milliards FCFA levés en IPO historique

Mobilisation record des particuliers : Les investisseurs individuels ont dominé avec plus de 71% des souscriptions, élargissant massivement la base actionnariale en CEMAC et démontrant un appétit pour les valeurs locales dans un contexte économique gabonais fragile. BGFIBourse, filiale du groupe, a orchestré l'opération, validée par la COSUMAF après prolongations jusqu'au 7 février 2026.

Article's detail -

Le Gabon émet un emprunt obligataire de 85 milliards F.cfa sur le marché financier de la CEMAC

Le Gabon a lancé avec succès un emprunt obligataire de 85 milliards FCFA sur le marché financier régional de la CEMAC, structuré en deux tranches pour financer prioritairement ses infrastructures et relancer l'activité économique. Cette émission, adossée au FCFA et gérée par la BVMAC, s'inscrit dans une diversification des ressources au-delà des partenaires multilatéraux, dans un contexte de chute des recettes pétrolières et de dette publique flirtant les 60% du PIB.

Article's detail -

Hausse du prix du pétrole Brent à 78 USD : Une bouffée d’oxygène pour les finances publiques gabonaise

La flambée du Brent au-dessus de 78 dollars le baril – +8% en deux jours à 78,49 $ le 2 mars 2026 – dopent instantanément les recettes d'exportation du Gabon, pays où le pétrole représente 80% des revenus extérieurs et 50% du budget. Après une année 2025 à 65-70 $ en moyenne, chaque dollar gagné injecte environ 25 milliards FCFA supplémentaires via les 7 millions de barils produits annuellement.

Article's detail -

Pourquoi Fitch Rating abaisse encore la note souveraine du Gabon ?

Fitch Ratings a abaissé la note souveraine du Gabon à CCC- (devises étrangères) et CC (monnaie locale) fin décembre 2025, signalant un risque "substantiel" de défaut dans un contexte de crise aiguë de liquidités et d'absence de programme FMI. Cette dégradation, la plus basse catégorie d'investissement, reflète des déficits budgétaires explosifs (6,1% du PIB en 2025 vs 3,7% en 2024) et des arriérés cumulés à 13,2% du PIB.

Article's detail -

L’agence Moody’s dégrade la note d’Eramet après une année chaotique

L'agence de notation Moody's a abaissé mardi la note de crédit à long terme du groupe minier français Eramet de B1 à B2, passant d'une perspective négative à stable. Cette décision sanctionne une performance opérationnelle décevante en 2025, marquée par une chute de 54% du résultat opérationnel ajusté à 372 millions d'euros et un endettement net grimpant à 1,9 milliard d'euros. Les prix des métaux en berne et les surcoûts logistiques ont amplifié cette dérive des indicateurs financiers.

Article's detail -

CEEAC : 1ère session annuelle du Comité des sages

Au sortir de sa première réunion statutaire annuelle ce 4 mars 2026 à Libreville, le Comité des Sages de la CEEAC s’affirme comme la clé de voûte de la stabilité régionale. Entre médiation préventive et soutien aux transitions, cet organe de haut vol dessine les contours d'une souveraineté politique retrouvée, capable de transformer les tensions en dialogues fertiles.

Article's detail